Bank Reconciliation

Bank reconciliation means comparing your records in AllMy Ledger to your actual bank statement. It catches mistakes, missing transactions, and unauthorized charges.

Step 1: Download Your Bank Statement

Log into your bank's website and download a statement file. AllMy Ledger accepts these formats:

- OFX — Open Financial Exchange

- QFX — Quicken Financial Exchange

- QBO — QuickBooks format

Most banks offer at least one of these. Look for "Download Transactions" or "Export" in your online banking portal.

CSV is not supported for bank imports. If your bank only offers CSV, check if they have an OFX or QFX download option — most do.

Step 2: Import the File

- In AllMy Ledger, go to File → Import → Bank Statement

- Select the bank account to import into

- Browse for your downloaded file

- Click Import

Step 3: Match Transactions

After import, AllMy Ledger compares the bank transactions to your existing records and suggests matches. For each transaction:

- Matched — the bank transaction matches an existing record. Confirm and move on.

- New — no match found. Categorize it and add it to your books.

- Duplicate — already recorded. Skip it.

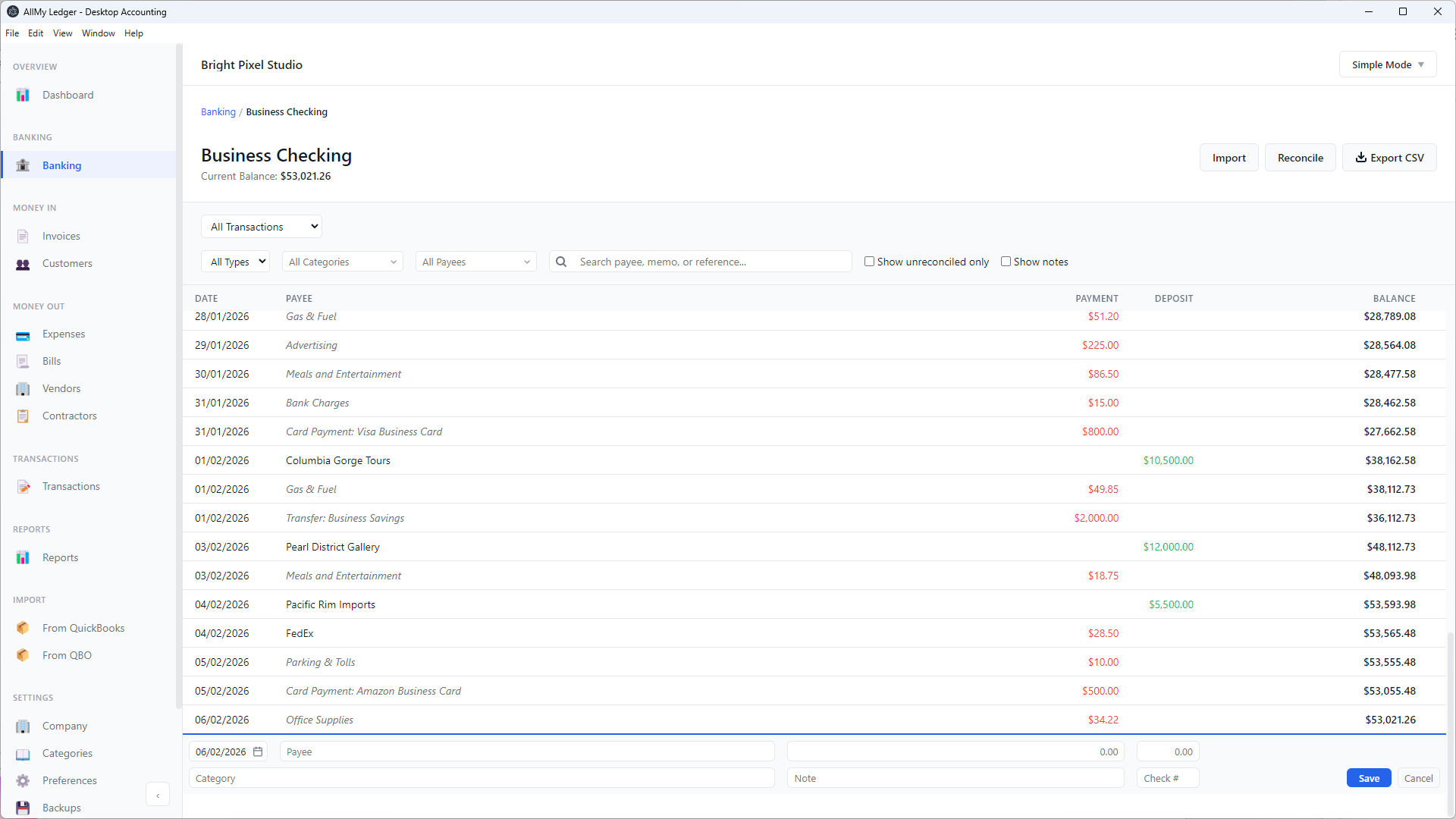

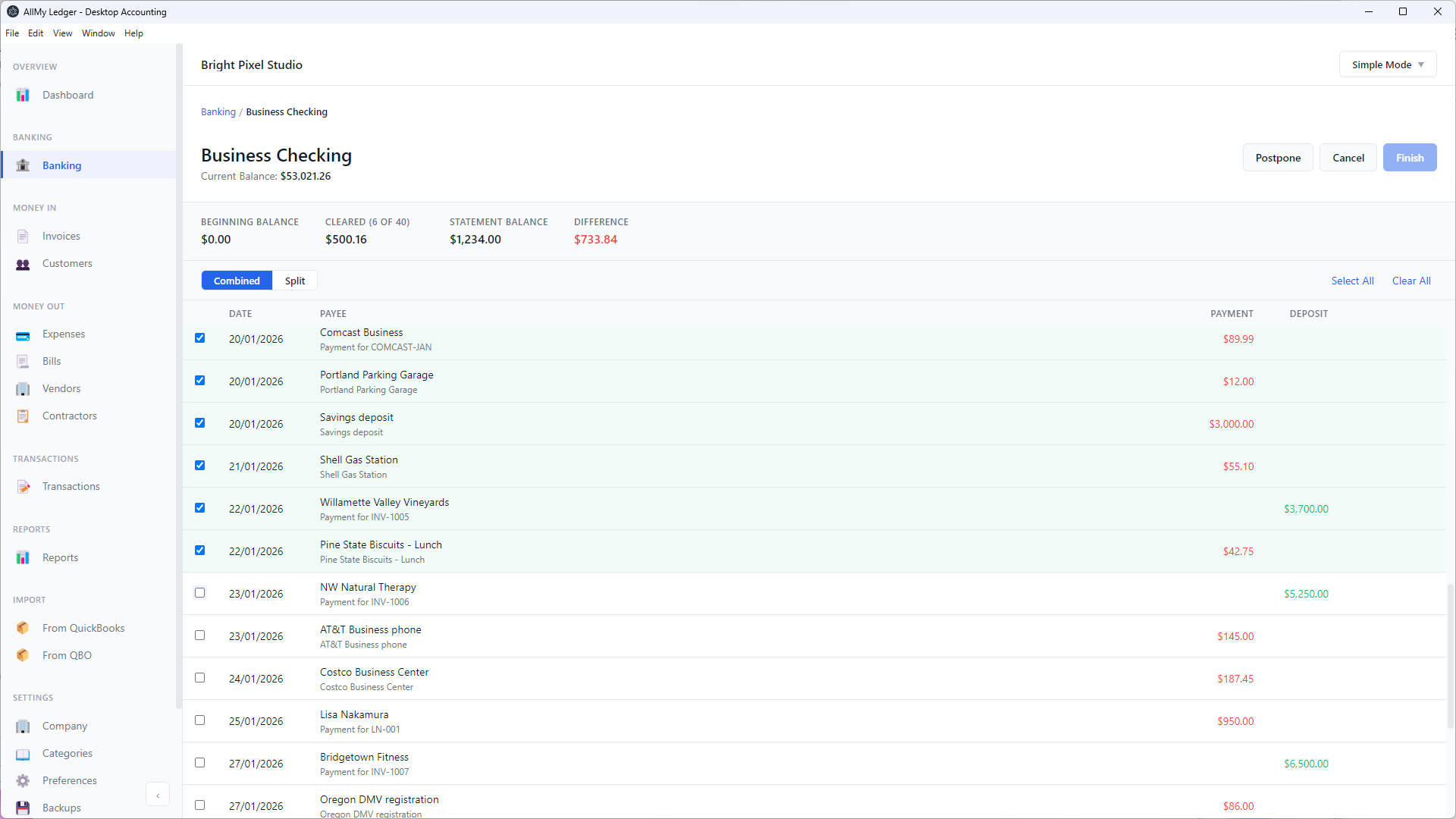

Step 4: Reconcile

Once all transactions are matched, compare the ending balance in AllMy Ledger to the ending balance on your bank statement. They should match. If they don't, review unmatched items.

Tips

- Reconcile monthly. Do it when your bank statement closes. Don't let it pile up.

- Review unmatched items carefully. They might be transactions you forgot to record, or bank fees you didn't expect.

- Check the statement date range. Make sure you're comparing the same period in both places.